The importance of analytics for incentive programs

Many channel-facing companies face a common set of problems when designing incentive programs. They don’t know what types of incentives to run for different channel partners. And they don’t know what channel partners are doing well, or not doing well, so they don’t know what they should be incentivizing.

Actionable insights are critical for obtaining the insights necessary to inform program design. Enterprising companies are increasingly using data analytics to expand the frontier of value creation in their pipeline.

McKinsey shows that 53 percent of “high performing” global sales organizations rate themselves as effective users of analytics. This is because this information guides stakeholders to more informed decisions that impact significant top-line and margin growth.

Although analytics have been widely heralded, they remain somewhat of a sideshow for a lot of companies. The same survey by McKinsey shows that most sales organizations today (57 percent) do not view themselves as effective users of advanced analytics. Many companies struggle to make informed business decisions using basic analytics, while some have yet to begin engaging with their data at all.

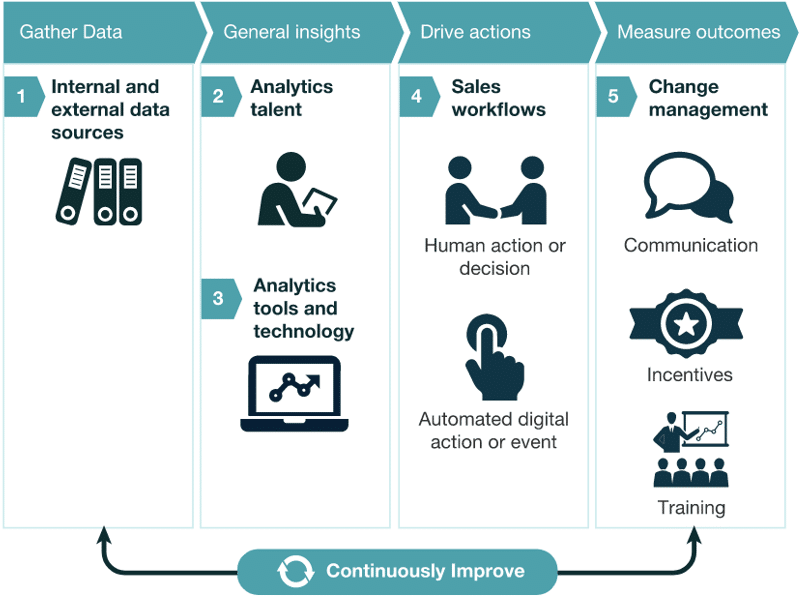

McKinsey found that utilizing data should be broken down into five stages: