The power of choice and control: essentials to designing a great loyalty program

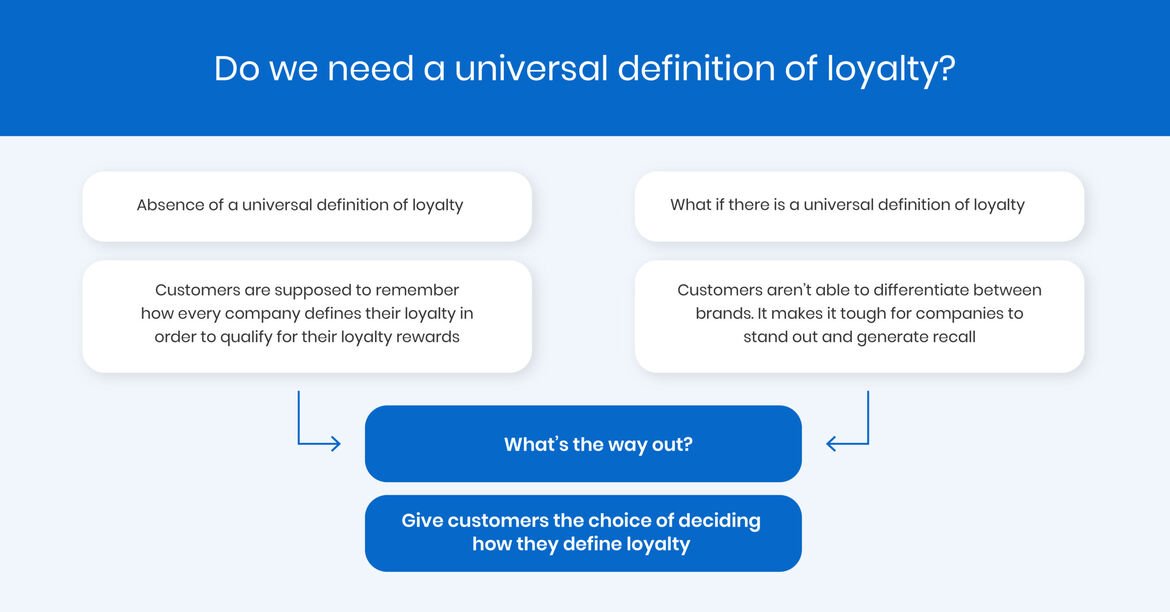

The vast majority of customer loyalty programs do little to engender customer loyalty. Companies decide by themselves what loyalty means to them. Sadly, very few of these companies give customers the choice of deciding what loyalty means to them.

“Loyalty” can’t be defined until customers have reached the advocate-for-you stage. For example, buying extra warranties or add-ons, referring them to family/ friends, tweeting about them to your network, or even offering feedback to improve some of their features – all are signs of loyalty. Only being recognized for their purchase makes customers feel undervalued – because their “value” only extends to their worth in a dollar sign. And that is not a good sign in a world that is spending billions of dollars to generate loyalty.

Let us understand some of the customer loyalty program models:

A) Point-based program

You earn points for each time the customer purchases. It is the simplest model of loyalty where the points translate into some type of rewards such as a discount code, freebie, or another type of special offer. This becomes complex for the customer since they have no visibility on the points and rewards earned.

B) Total purchase value

This is the total number of units purchased or the total number of dollars spent over a specified period. Dollars speak directly to the topline and reward customers more for buying more things or spending more.

The more you spend, the more you earn.

For example, if you spend more than $1000 with us this holiday season (a specified period), then you will earn [reward]; and if you spend more than $1500, you will earn [reward++].

Variations of this model that can be described as innovations and that drive total purchase value are:

- a model that positively reinforces cart non-abandonment. In another world, it might have been easier to take away points from a customer for abandoning their cart, but nobody wants to do that. You can always award points for not abandoning carts

- contests or sweepstakes where the purchase requirements to play/ be eligible are attainable and higher spending imply higher rewards

- offering non-monetary rewards based on customer’s values. The more you spend, the bigger the donation to your preferred charitable organization or cause

C) “Big spender” model (average transaction size)

This doesn’t depend on the amount spent in a period, but when they make a purchase, it’s a big purchase. The highest average spend is rewarded more.

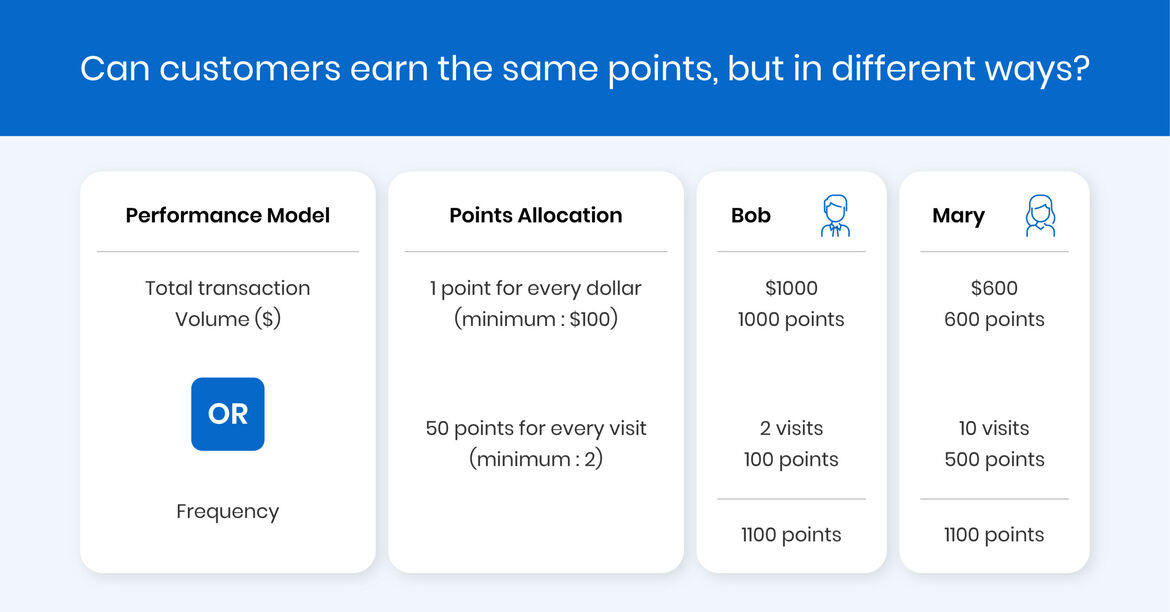

D) Number-of-transactions model (frequency of purchase)

This is the punch card model. After a certain number of transactions, you are rewarded with an extra meal or a free haircut or a free car wash, and such. It is popular because it is easy to implement. Small retailers and small restaurants make a beeline for this. This also brings into mind the recency factor, does it not?

Let’s look at a derivative of the transaction model – It’s the frequency model or the number of transactions over time. It is time-bound. The customer is rewarded for how often they do business with you over a period of time. It is the best PROXY for loyalty.

Some of these are growing in popularity, but all of them are one-dimensional. Some customers try to adhere to these models to get some rewards, but there’s no universal measure of gauging customer loyalty.